Simple Summary

This proposal aims to revamp the 1inch staking system by prioritising enhanced delegation to streamline and empower stakeholder participation

-

A new time-lock model where staked 1INCH generates “Unicorn Power” (UP) based on an exponential multiplier.

-

A unified delegation system allowing a single stake to empower both a resolver and a governance delegate simultaneously.

-

A DAO Treasury-funded rewards program to provide a base APR in 1INCH.

-

A revised early withdrawal penalty that is fairer to long-term stakers and benefits the community.

Abstract

The current 1inch staking system suffers from low participation, fragmented delegation, and unclear incentives, hindering decentralisation. Staking v2 addresses these by replacing the decaying st1INCH with an exponential “Unicorn Power” (UP) system, unifying governance and resolver delegation into a capital-efficient “Dual-Delegation” model, and introducing a treasury-funded base APR to boost participation. This overhaul aims to increase staking, decentralise voting power, and enhance the 1INCH token’s utility.

Motivation

The “why” of this proposal is to solve several critical issues hindering the growth and decentralisation of the 1inch DAO:

-

Low Governance Participation: The previous lock-up mechanism was not sufficiently attractive, leading to a low number of stakers. This results in low overall Voting Power (VP), making it difficult to reach the 10M quorum required to pass proposals.

-

Centralised Voting Power: Due to low community participation, a majority of the existing VP is held by the core team, creating a centralised governance structure that is not ideal for the long-term health of the DAO.

-

Inefficient Staking Power: Staking is fragmented into two separate systems: one for governance and one for resolvers. A significant amount of delegated power is locked in the resolver system, unable to be used for governance. This is a confusing user experience and a massive waste of potential VP.

-

Weak Staking Incentives: The current reward of “50% of DAO revenue” is not a strong incentive when protocol revenue is nascent or zero. Potential stakers lack a clear, predictable return on their commitment.

This proposal aims to make staking 1INCH a simple, rewarding, and powerful action that directly contributes to the security and vitality of the entire 1inch Network.

Specification

1. Unicorn Power (UP) Generation

The st1INCH token and its decay model will be deprecated in favour of a direct, exponential multiplier system.

-

Locking: Users lock 1INCH tokens for a chosen duration, which can range from a minimum of 1 week to a maximum of 104 weeks (2 years).

-

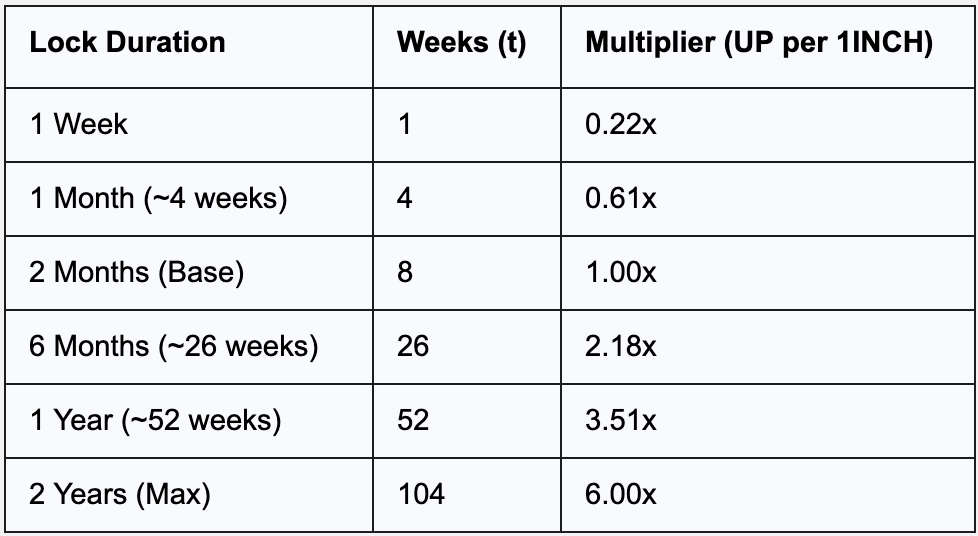

Multiplier Formula: Upon locking, the user is granted a fixed amount of Unicorn Power (UP). The multiplier M(t) applied to their staked 1INCH is calculated with the following formula, where t is the lock duration in weeks: M(t)=(t/8)^0.698

-

This formula sets a baseline of 1.00x UP for a 2-month (8-week) lock. Locks shorter than 8 weeks will receive less than 1x UP, while longer locks will see their UP grow exponentially to a maximum of 6.00x at 104 weeks.

-

Example Multipliers:

- UP Balance: The resulting UP balance is static for the duration of the lock and is tied to the user’s address.

2. The Unified Dual-Delegation System

A single UP balance will be used for both governance and resolver delegation.

-

Resolver + Delegate Pair: From a unified interface, a staker will assign their total UP to a “pair” of addresses: one for a Governance Delegate (can be themselves) and one for a Network Resolver.

-

Power Allocation: If a user has 100 UP, their chosen delegate receives 100 UP for use in Snapshot governance voting, and their chosen resolver receives 100 UP for use in the resolver boosting mechanism.

3. Staking Rewards Mechanism

-

Base APR: A new rewards contract will be deployed to distribute a Base APR in 1INCH. This contract will be funded periodically by the 1inch DAO Treasury through formal governance proposals. Rewards will be distributed pro rata to all stakers based on their share of the total UP in the system.

-

Protocol Revenue: The existing commitment to share 50% of protocol revenue will be maintained. It is specified that this revenue should be converted to USDC before being distributed to stakers to provide a “Real Yield”.

4. Early Withdrawal Penalty

The penalty for exiting a lock early will be made fairer and will benefit remaining stakers.

-

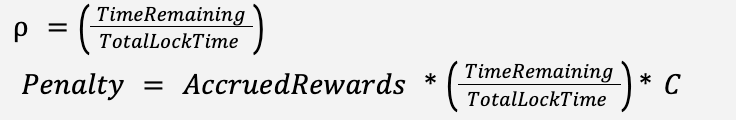

Penalty Formula: The penalty is calculated as a decaying factor of accrued rewards and is proportional to the time remaining on the lock.

The constant C will be a parameter controlled by the DAO, with a suggested initial value of 1.5. The penalty is capped at 100% of the user’s accrued rewards.

-

Principal Penalty: To further disincentivise short-term staking, if a user withdraws within the first 10% of their chosen lock duration, a flat 0.5% penalty on their principal stake will be levied in addition to the forfeiture of accrued rewards.

-

Penalty Redistribution: All tokens collected from penalties will be sent to the staking rewards contract and distributed among the remaining locked stakers.

Rationale

- Exponential Multiplier: An exponential curve strongly incentivises long-term commitment, which is crucial for DAO stability. Setting the 1x baseline at 2 months creates a clear psychological benchmark, while allowing shorter-term locks provides flexibility.

The formula m(t)= (t/8 )^0.698 was chosen as it elegantly connects the 2-month (1x) and 2-year (6x) targets.

-

Dual-Delegation: The “Resolver + Delegate Pair” model is superior to alternatives as it maximises the capital efficiency of every staked token. It solves the VP cold-start problem by immediately integrating the large pool of resolver-focused stakers into the governance ecosystem without forcing them to choose one over the other.

-

Treasury-Funded Rewards: With protocol revenue currently at zero, a treasury-funded Base APR is the only viable method to bootstrap the staking ecosystem. This investment from the DAO is a direct commitment to decentralisation.

-

Proportional Penalty: The proposed penalty formula correctly aligns incentives. It heavily discourages exiting a lock early on but becomes progressively lenient. Redistributing the penalty directly rewards the most loyal network participants.

Considerations

Security:

-

Smart Contract Risk: The new staking, rewards, and delegation logic will be encapsulated in new smart contracts. These contracts MUST undergo at least two independent, comprehensive security audits before deployment.

-

Migration: A clear and secure migration path must be designed for users of the current staking system to transition to Staking v2.

Governance:

-

Cost to Treasury: The most significant impact is the financial commitment from the 1inch DAO Treasury to fund the Base APR. The size and duration of this rewards program will be a major governance decision and will require a separate 1IP to define the budget.

-

Impact on Voting: This proposal is expected to have a profoundly positive impact on governance. By unlocking dormant power and heavily incentivising new stakers, the total community UP should increase dramatically, making it easier to reach quorum and diluting voting concentration.

-

Ongoing Program Management: The success of the Base APR program requires active management. The DAO will need to periodically review staking metrics and treasury health to propose new funding tranches, making this an ongoing commitment.

Next steps

- Got consensus to build the staking contract.

- Initial Audits and security checks.

- DAOplomats making the initial deployment after final approval from the DAO (through a subsequent vote)

- Yes

- No

- Abstain